Tuesday, August 14, 2012

Productivity - for whom and for what?

In their insatiable quest for maximum profits the ruling class has a single-minded focus on raising productivity. Bourgeois economics defines productivity as a ratio of outputs of production to the inputs required for its creation. While national productivity is thus a measure of the effective utilisation of many inputs including investment in plant and machinery, costs of resources, costs of labour power, management expenses, and taxation and so on, the immediate target of the ruling class in its push to raise productivity is always the cost of labour power.

Marx identified two components of capital in the process of production: variable capital (wages - the price of labour power) and constant capital (capital invested in plant, equipment and materials). He described the ratio of the one to the other as the organic composition of capital as it was, in effect, a ratio between living capital (wages - the cost of a commodity that can create new value) and dead capital (the cost of those commodities which cannot by themselves create new value).

In his lengthy investigation into the economic laws of motion of modern capitalism Marx indicated that, as a general trend, the share of constant capital in the total outlay of capital increases, and that labour input per product unit declines. Furthermore, he revealed how the competition between capitalists required the lowering of the prices of commodities and that this was substantially brought about by investment in newer and more productive equipment and the application of newer and more effective technologies. This meant a rise, over time, in the organic composition of capital which would lead to a declining rate of profit; for every new increase in profits from sales, an even larger corresponding increase in constant capital investment becomes necessary. The obvious corrective to a decline in the rate of profit is a reduction of variable capital.

For example, if at the start of a production process a business has a variable capital cost of 8 units, and its investment in plant and its ongoing cost of materials amounts to 4 units, then it is producing at a rate of 200% on its outlay. However, if a rival firm is established after technological advances make cheaper and more efficient plant available to it, and/or the rival becomes supplier of materials to its own production process, then it will undercut the older competitor assuming the cost of labour power remains the same. The original firm is forced to invest in new plant and new technology to make its products more cheaply and efficiently, but the new constant capital costs are in addition to the old constant capital costs and so the denominator increases to 6 units. If wages remain the same, the rate of profit drops to 133% - still enough to cover costs but not enabling the previous rate of profit to be maintained. There can only be a return to the previous rate of profit (200%) if the cost of labour power can be reduced to 5.2 units.

Please don’t accept that very superficial analysis as in any way doing justice to the majesty and sweep of Marx’s Capital and other writings.

Just keep it in mind as we return to the question of productivity as a concept in capitalist economics.

By way of newspaper headlines and ”serious” TV, the ruling ideas of society about productivity never give any real airing to management responsibility for declining productivity.

Instead, the discussion is always about “labour productivity” or the amount of goods and services that a worker produces in a given amount of time.

Hence the Murdoch rag The Australian on July 3: “Productivity first, not wages: Simon Crean and Martin Ferguson turn on union family”.

Hence a national enquiry prompted by the most reactionary circles of the ruling class and their assertion that the industrial legislation embedded in the Fair Work Act is denying employers the right to a more “flexible” workforce.

All of this is despite the fact that productivity according to bourgeois economists has a whole range of inputs and that it can actually rise as wages go up. It can also actually rise as constant capital costs increase and profits drop. It is possible as Gerry Harvey bemoaned on the weekend, to have increasing manufacture of wide-screen televisions at the same time as there is a decrease in demand. The problem is therefore not low productivity but overproduction. (Harvey seems to have accepted that the problem is not on-line sales from overseas suppliers – his position last March – but overproduction.)

But for all their gnashing of teeth, the bosses have very little to complain about in terms of productivity. According to the IMF in 2011, Australia ranked fifth highest out of 34 OECD economies in terms of productivity – behind Luxembourg, Norway, Switzerland and Denmark. There is never celebration of our high levels of national productivity. Indeed the Financial Review had the following little in-joke for its mainly business and financial circles readership:

For its particular readership, this cartoon is designed to provoke agreeable chuckling (“Yeah, that’s right, let’s get on with it…”). In a working class paper, it would provoke outrage.

Productivity can vary between sectors of the economy, as the following graph shows.

The mining sector has seen the greatest increase in productivity and, beginning during the Howard years, a no less dramatic decline. A little later in the Howard years, a decline set in in the accommodation and food services sector. But four other sectors, construction, manufacturing, retail trade and financial and insurance services have all seen relatively steady growth for close to a quarter of a century. So there is clearly no basis for using gloom-and-doom stories about productivity for launching attacks on workers’ wages and conditions via a return to the draconian Howard-era industrial laws. Today’s are bad enough!

(The negligible impact of Labor’s Fair Work Act on productivity, revealed in the graph above, led one letter writer published in the Fin Review to observe: “In the absence of discernible effects(of the FWA) on national productivity, the spotlight will then fall squarely upon what it should: the extent to which management sloth, incompetence and commercial turpitude have contributed to the nation’s problem.” - Mike Martin Fin Review 10/8/12. We won’t hold our breaths waiting…)

Data from the University of Sydney’s Workplace Research Centre on the relationship between labour productivity and real wages (ie wages expressed in terms of what they can actually buy over a defined period of time) confirms that it is not wages that lie behind the so-called “problems” with productivity:

ABS data also shows that starting from a common index point of 100, wages have actually declined in terms of their share of national income, whilst profit’s share has substantially increased:

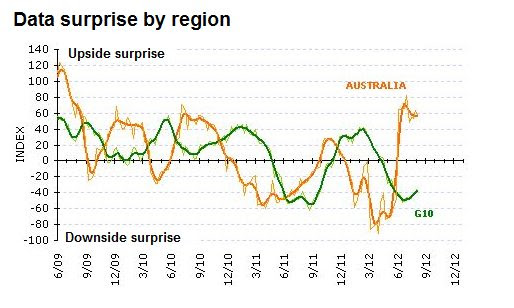

And Alan Kohler has shown recently, using data from the US bank Morgan Stanley that Australian corporate profits are doing very nicely compared to countries in the Group of 10.

It is in their very real interests that Australians not be hoodwinked by productivity sob-stories into thinking that there is a problem, and that they are to blame. There is a problem – the compulsion to increase productivity not to meet real social need but to put the competitors out of business.

We need a system that connects productivity to social need not to private profit.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment